SAP Group Reporting: New Features for Future Challenges

SAP implements co-innovation suggestions

What Is SAP Group Reporting?

SAP Group Reporting is SAP's strategic consolidation solution that is seamlessly integrated into the SAP S/4HANA ERP platform. It combines classic features of established legacy tools with the "HANA coherence approach" (ACDOCA as the leading DB table) and innovations such as AI and Green Ledger Accounting. SAP stands by its promise to users and has already shifted many new features in recent months; it will continue to develop the Finance Platform in 2025 along the published roadmap and adapt it to customer needs. The development team is paying particular attention to suggestions from the user community from the Customer Influence Platform (CIP).

Integration of Reporting Is a Core Element for Sustainable Value Creation

The importance of integrated reporting solutions for corporate groups will continue to grow. Only based on consolidated financial information can well-founded analyses of the net assets, financial position, and results of operations of globally active corporate groups be carried out, and the evolving legal requirements can be met. Non-financial data from the ESG context is also increasingly coming into focus - for example, when banks base their lending decisions on it.

In times of crisis, closing speed is crucial for corporate management to react quickly to changing market conditions and realize sustainable value creation for stakeholders. In addition, the auditor will also carry out in-depth analyses in the context of financial reporting (e.g., about risk management or refinancing strategies) and thus challenge the integrity of the financial processes. At the same time, finance departments must respond to increasing cost pressure and the shortage of skilled workers by leveraging efficiency potential and automation options in the R2R process.

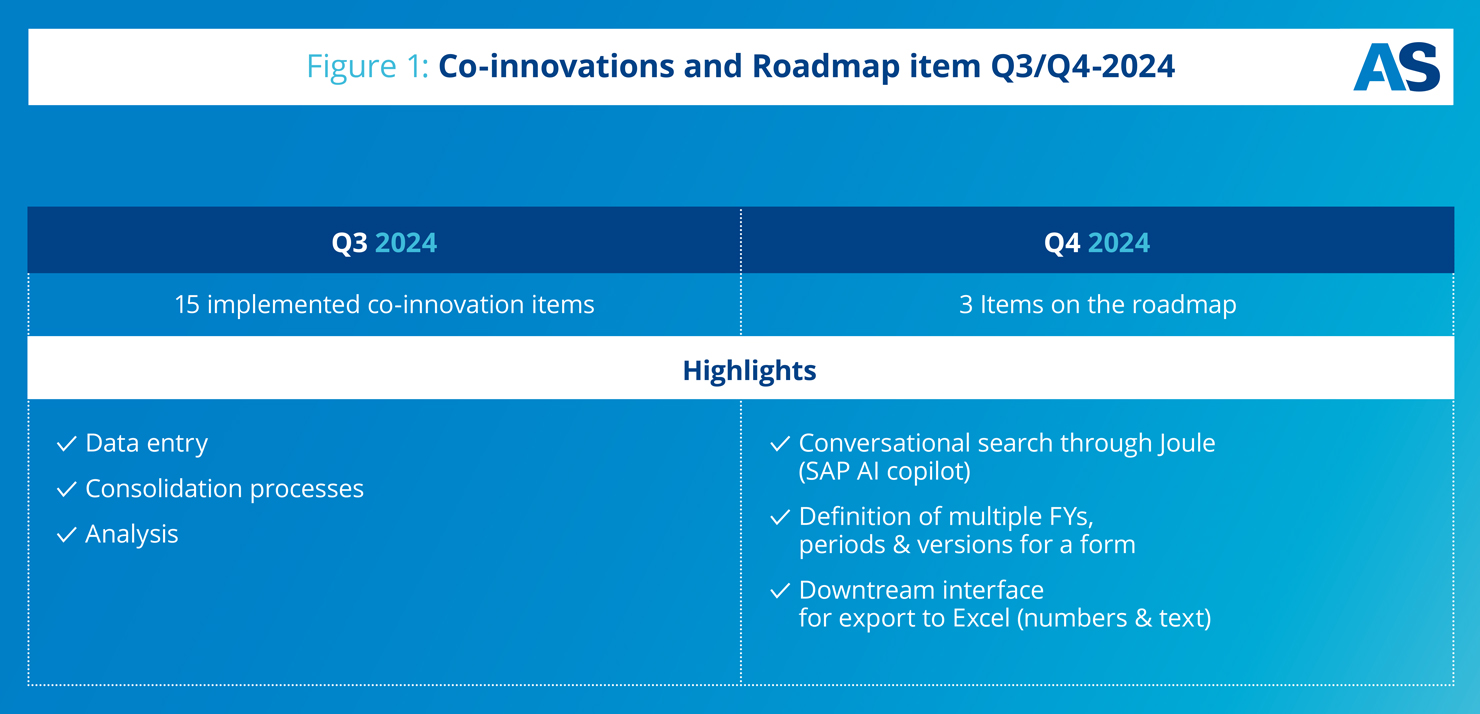

Implementation of Co-innovation Topics in 2024

With the help of the Customer Influence Platform (CIP), the SAP user community can discuss and vote on suggestions for further developments to the financial platform. The SAP Group Reporting development team in Paris recently confirmed that more than 15 suggestions from the CIP were implemented in the third quarter alone, including:

- Six improvements for data collection, including a new dashboard view of SAP Group Reporting data collection jobs by status

- Seven improvements to the consolidation process, including the ability to adjust the partner unit during the balance forward

- Three improvements for analytics, including the ability to combine data and use reporting rules in SAP Analytics Cloud

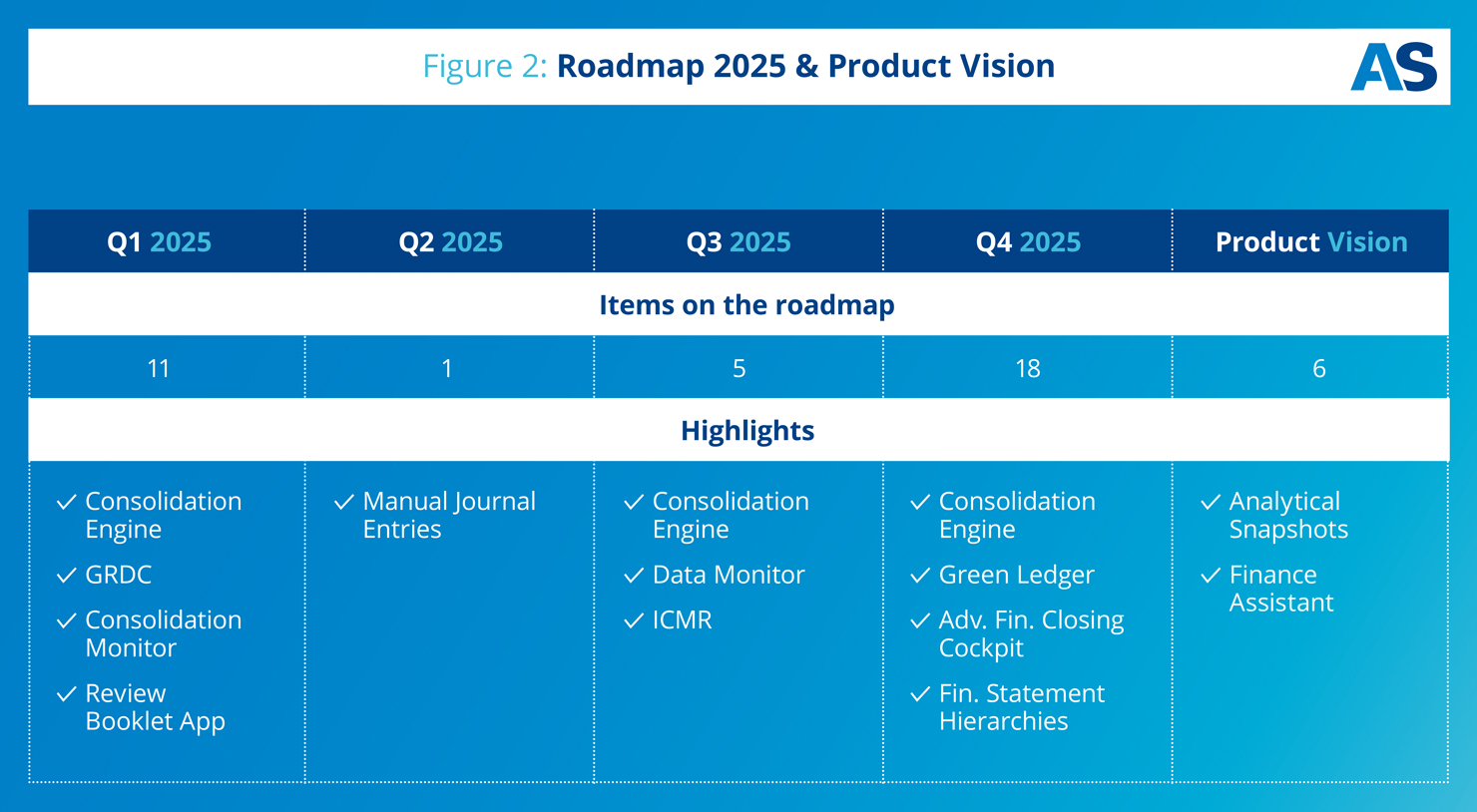

Roadmap Q4-2024 and 2025

Based on the current release 2408, new features will be shifted in 2024. As usual, the new features will first appear in the cloud version before being made available in the on-premise version. For Q4, the first onboarding steps for the SAP AI assistant Joule and improved downstream interfaces for exporting to Excel spreadsheets from the SAP Group Reporting Data Collection app will undoubtedly be in the foreground.

- New functionalities for the Review Booklet app, including real-time access to accounting data and improved drill-through properties

- Multiple validation options (also for unreleased data)

- A new Consolidation Monitor app with improved UX, including One-Click-Conso

- Empowerment for the consolidation engine: rule-based automation of consolidation group-dependent postings

- Deeper integration of the management of intercompany reconciliation processes (ICMR) into the Group reporting closing processes

- Group-level Green Ledger: Recording and consolidation of greenhouse gas emissions for group reporting (private cloud and on-premise)

- Deeper integration of the Advanced Financial Closing Cockpit with Group Reporting, e.g., by controlling the data collection process in the AFC

- Introduction and use of time-dependent financial statement hierarchies

Sap Group Reporting: Product Vision from 2026

In terms of prospects, the measures listed on the roadmap for the Group Reporting product vision are less precisely defined:

- Use of AI in the form of a finance assistant to increase closing efficiency

- Continuous Group Reporting: Analytical snapshots for power users to display and publish financials and non-financials from previous periods at any time

- Additional validation measures to increase the quality and confidence in financial statement data

Written by

Prof. Dr. Martin Wünsch is an expert in financial reporting and SAP S/4Hana Finance Consulting. He is familiar with this field from various perspectives, e.g., Big4-Audit, Corporate Functions, or Management Consulting. He holds a chair in Business Administration, in particular in Int, Accounting & Controlling, at the FOM University of Applied Sciences Düsseldorf and regularly publishes on current topics in financial reporting.